Timely filing calculator

Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR. 31 March 2018 was the deadline for filing belated return for AYs 2018-19 2019-20.

How To File Back Taxes Money

Other than an ex parte motion and except as otherwise provided by R.

. 120 121 or 365c. This means electronically filing FinCEN Report 114 FBAR by April 18 2022 to report foreign accounts that combined total more than 10000 at any time during 2021. Patient seen on 07202020 file claim by 07202021.

You can file Form 1040-X Amended US. HRA NSC Rebate under section 89 etc. If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR.

From there the 05 rate of the late filing penalty increases to 1 per month. All Utilities for ImportExportReport. Save More with Timely ITR.

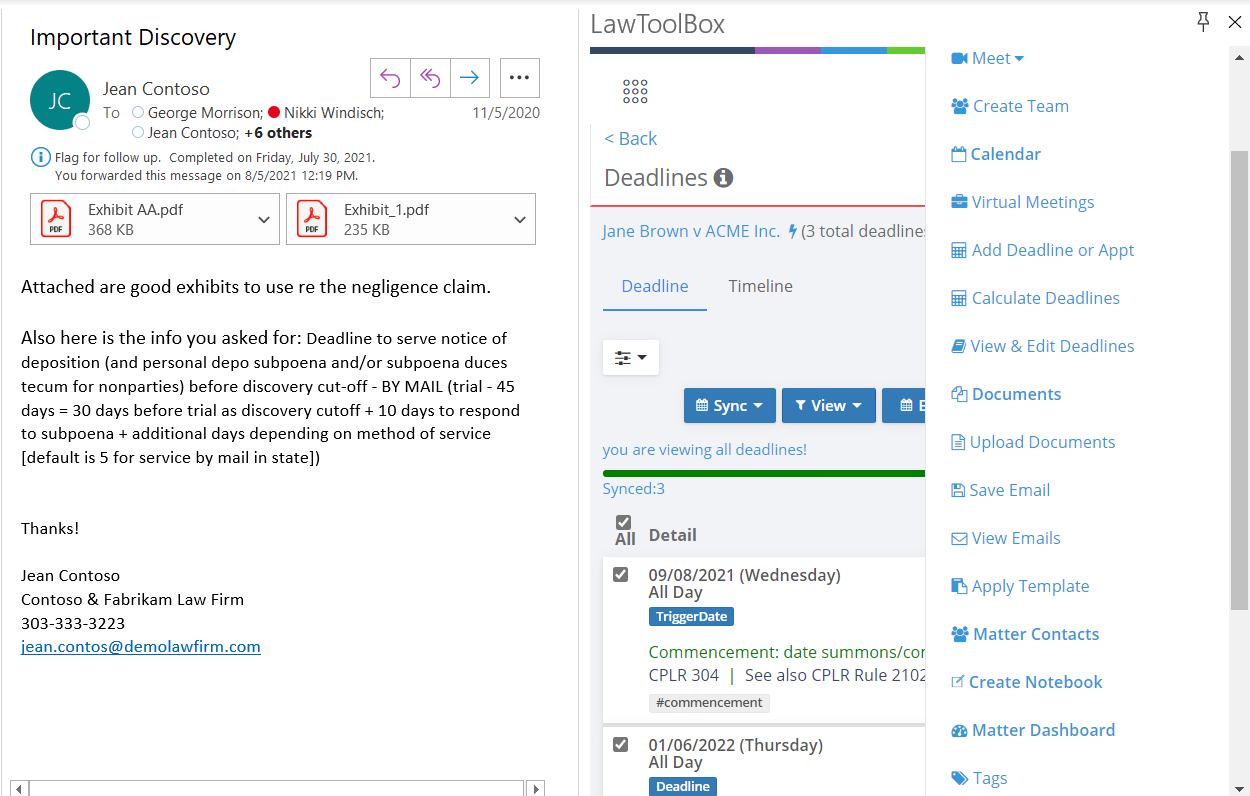

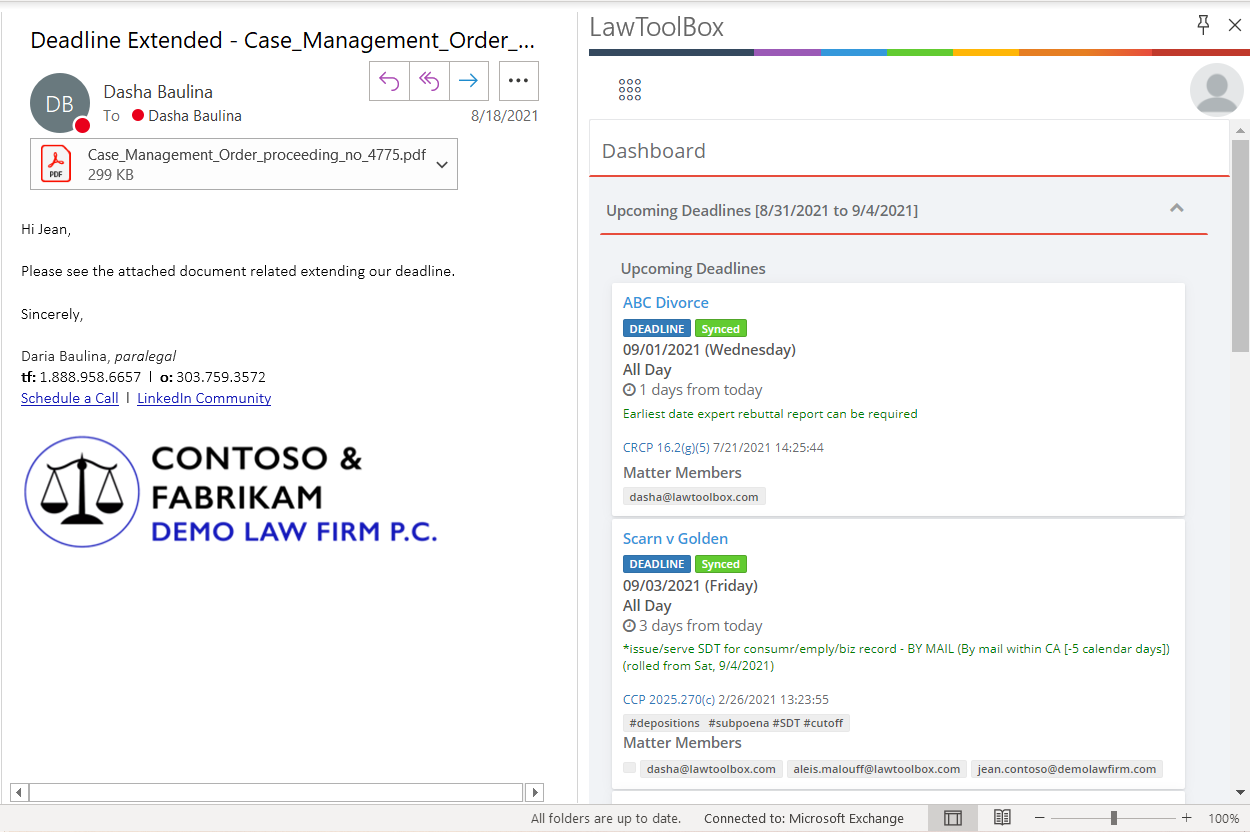

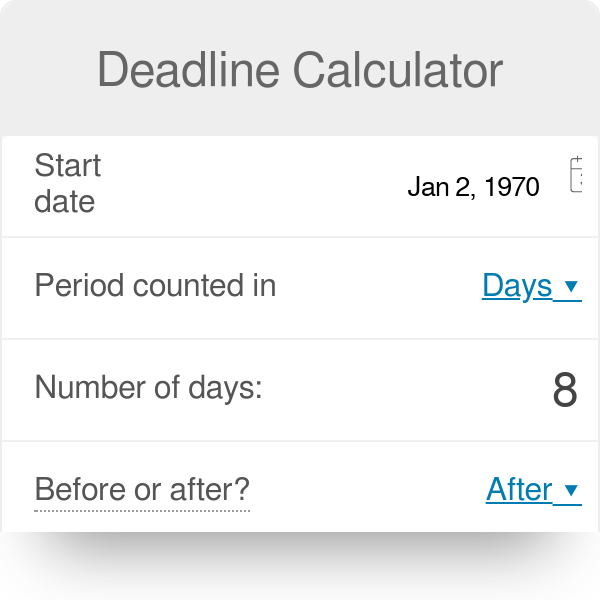

Timely payroll filing and reporting. System links to help determine these factors. Claims Timely Filing Calculator.

What happens if you miss the return filing deadline. Use the Claims Timely Filing Calculator to determine the timely filing limit for your service. It develops XML generation Challan e-payment auto-filled JSON Data etc.

46-2e dismissal for failure to state a claim R. Enter the DOS to calculate the time limit for filing the claim. See IRSgov for details.

Calculate taxes- Income Tax Calculator FY 2020-2021 AY 2021-2022. The calculator also excludes temporary provisions that were enacted in 2020 to provide assistance to taxpayers during the pandemic such as the 300 deduction for charitable. Your best option is a secured credit card.

We make no promises that the sum you receive will. The IRS late filing penalty is set to 05 of the tax owed after the due date and for each month the tax remains unpaid up to 25. It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household.

In this example the total penalty amount is limited to 10 percent per FCP Law plus the. If October 15 falls on a weekend or legal holiday you have until midnight the next business. This means after adding VAT the price of a product changed from AED100 to AED105.

Patent term extensions under 35 USC. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. After 10 days the IRS will issue a final notice of intent to seize property.

Timely payment of maintenance fees. The grant date of the patent. A late fee of Rs.

Other reasons commonly given by employers for not making a timely payment under Labor Code Sections 201 2015 202 and 2025 that do not relieve the employer of liability. Use our Probate Fee Calculator to determine what the probate fees charged by BC courts will be. However an individual is required to pay a late filing fee if heshe is filing belated ITR.

Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use. If you file your return after the due date you will have to pay interest under Section 234A 1 per month or part month on the unpaid tax amount. Filing a wage claim with the Labor Commissioners office DLSE is not considered an action and does not prevent the waiting time penalty from continuing to accrue.

The government is not considering extending the last date for filing income tax returns as it expects most returns to come in by the due date of July 31 a top official said on Friday. Electronic Certificate of Conformity e-CoC for Vehicle Registration Tax VRT Online services. Uniform Motion to Amend Confirmed Chapter 13 Plan to Satisfy Recently Filed Timely Proofs of Claim view Emergency Motion to Impose the Automatic Stay.

55-4c post judgment motions a notice of motion shall be filed and served not later than 16 days before the specified return date unless. Credit Card Payoff Calculator. Filing and Service of Motions and Cross-Motions a Motions Generally.

Filing date of the application. Responsible use and timely payments can help you down the road to a better. Calculate your projected benefit by filling quarterly wages earned below.

And make a late tax payment. Access the Vehicle Registration Tax VRT calculator. It shall be reduced to Rs 1000 if the total income is less than Rs 5 lakh.

Advance Tax and Self-Assessment Tax Calculation. We created this calculator to aid you evaluate what you might obtain if you are entitled. Benefit claims under 35 USC.

When filing at a USCIS lockbox you may also pay by credit card using Form G-1450 Authorization for Credit Card TransactionsIf you pay by check you must make your check payable to the US. Patent term adjustments and extensions under 35 USC. Sign in or register.

5000 under Section 234F will need to be paid. Motion for Continuation of the Automatic Stay. With our VAT Calculator in Dubai If you enter the amount as AED100 and VAT rate as 5 and click on Add VAT the VAT amount becomes AED05 and the total amount is AED105.

Our probate lawyers focus only on wills and estates law. All Medicare claims must be filed within one year after the date of service DOS. Department of Homeland Security.

Maryland Unemployment Calculator. Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. 446-1 summary judgment and R.

If you file your form by mail paper you may pay the fee with a money order personal check or cashiers check. To determine the 12-month timely filing periodclaims filing deadline we use the From date on the claim. If you timely file Form 4868 you have until October 15 to timely file your return.

Debtors Objection to IRS Claim. Claims received after the date displayed will be considered past the time limit for claim submission. In addition a 50 percent penalty also applies according to Cannabis Tax Law section 34013f.

Belated return Penalty for Late Filing of Income Tax Return - Read this article to know how to file belated returns and what are the consequences of late filing of return. If your score is a bit loweraround 680you can lose between 130 and 150 points. Gen IT is an income tax software for the fastest e-filing ITRs and computing income.

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. MyAccount is a single access point to secure online services such as PAYE services including Jobs and Pensions HRI MyEnquiries and more.

Paycheck Manager Makes Payroll Processing Easy. Filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. Filers who miss the April 15.

A 10 percent penalty applies for the late payment and the late return filing following the Fee Collections Procedures FCP Law.

Irs Penalty For Late Filing H R Block

Deadline Calculator Court Date Calculator Legal Deadline Calculator

How To Obtain A Us Taxpayer Identification Number Mnp

Online Bookkeeping Services In Canada Still Cpa Professional Services

Deadline Calculator Court Date Calculator Legal Deadline Calculator

90 Day Early Filing Date Calculator Christians Law Pllc

2022 Canada Tax Filing Deadline What You Need To Know Compass Accounting

Laser Cut Calculator Organizer For Teachers 4 Steps With Pictures Instructables

Tax Dawdlers It S The Last Minute Here Are Tips On Filing The New York Times

Corporate Accounting And T2 Tax Returns Still Cpa

![]()

Timely Filing Calculator Medisoft Blog From 2k Medical

Multi Function Portable Filing Folder A4 Portfolio Memo Pad Holder Manager Sales Padfolio With Calculator Magnetic Clasp 1308c File Folder Aliexpress

Deadline Calculator

Timely Filing Calculator Medisoft Blog From 2k Medical

1170 Handheld Business Calculator W Slide Case By Victor Vct1170 Ontimesupplies Com

7 Best Payroll Calculators In Canada Canada Buzz

How A Payroll System Works